Our Irvine, CA Foreclosure Lawyer Helps Protect Your Home

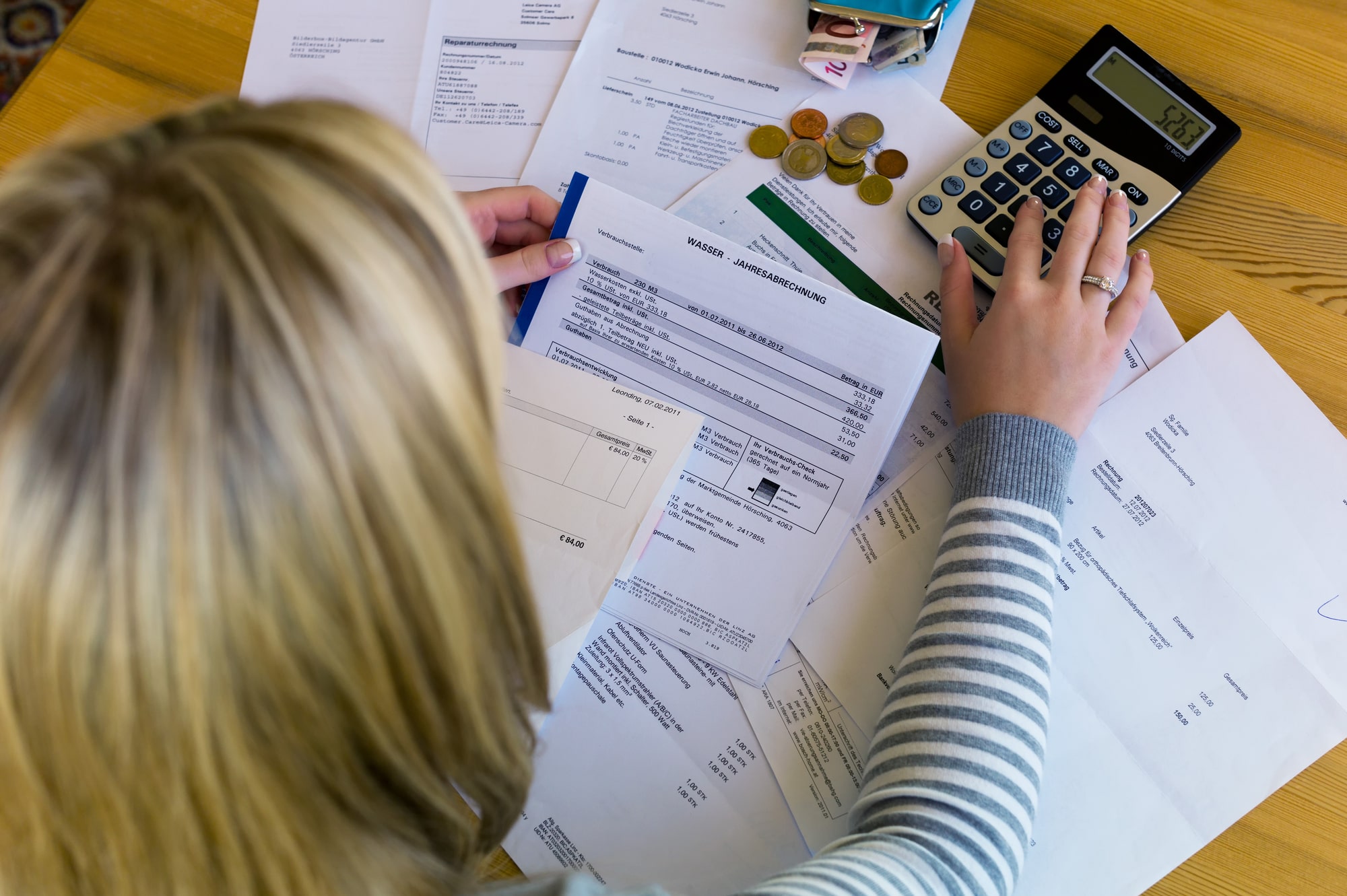

For many California homeowners, their house is the largest and most important purchase they’ll make in their life. The sad reality is that many homeowners are just one financial mishap away from losing their homes in foreclosure. Job loss, an accident or serious illness that prevents you from working, divorce, or plain bad luck can put you far enough behind on your mortgage that your lender may place your home in pre-foreclosure. Who can you turn to for help when you’re in danger of losing your house? Our Irvine, CA foreclosure lawyer can find a workable solution no matter how far into the foreclosure process you are.

When you work with the attorneys at Katje Law Group, you benefit from our years of experience negotiating fair solutions for homeowners in foreclosure. We strive to keep you in your home, preserve the equity you’ve put in, and protect your credit score from the negative impact a foreclosure would have on it. You have to act fast, though. Once a lender has started the foreclosure process, every day matters. Contact us today for a personalized strategy session.

The Importance Of Legal Representation In Foreclosure Proceedings

When days matter, you don’t have a lot of time to waste reading the fine print of your mortgage documents and the California laws covering the process. Our lawyers move into gear right away, deploying legal strategies such as injunctions to pause the foreclosure process and give you a little breathing room to negotiate with the bank. We know each situation is unique, so we consider your needs. Do you want to try to keep the house, or would you rather negotiate a favorable short sale and keep the equity? We consider your needs as we develop our recommended legal options.

You typically have more options when you’re in pre-foreclosure if you’re just a little behind on payments. Mortgage lenders would usually rather keep getting their money from you rather than going through a lengthy foreclosure and a bank sale of the property. Often, we’re able to negotiate more favorable terms to repay your mortgage, such as reduced payments, an extension of the loan, or lower interest. If you have already been served with a notice of a foreclosure lawsuit, our options become more limited, but with each one, we look at every angle to develop the best outcome for you and your family.

Your Trusted Legal Team In Foreclosure Actions

Some mortgage lenders may be unable or unwilling to stop the foreclosure process and renegotiate a home loan with you. In these situations, our Irvine foreclosure lawyer can help arrange a short sale of the house, which can help you avoid having a foreclosure on your credit score and give you time to find a new place to live. You may be able to keep some or all of the home equity you built, too.

We can also help protect your credit score. A foreclosure can drop it by about 300 points, affecting your ability to get another home loan or even rent somewhere. We want to help avoid that for you. Contact Katje Law Group today for a consultation.

Legal Options Homeowners Have To Fight Foreclosure

Since 2011, our Irvine, CA foreclosure lawyer has helped individuals understand their rights and take action when they receive a foreclosure notice. Facing foreclosure can be overwhelming, but homeowners have legal options to protect their property and financial future. Acting quickly can make a significant difference in the outcome, and there are multiple paths to consider before losing a home.

Responding To A Foreclosure Notice

One of the first steps a homeowner should take is responding to any legal notices from the lender. Ignoring these documents will not stop the process and may result in losing opportunities to challenge the foreclosure. Many states have strict timelines for filing a response, so it’s important to review all paperwork carefully and take action as soon as possible.

Loan Modification And Repayment Plans

For those struggling to keep up with mortgage payments, a loan modification or repayment plan may provide relief. Lenders are sometimes willing to adjust loan terms, reduce interest rates, or extend payment periods to make monthly payments more manageable. A repayment plan can also help homeowners catch up on missed payments over time rather than requiring a lump sum.

Filing For Bankruptcy

Bankruptcy can temporarily halt foreclosure through an automatic stay, preventing the lender from proceeding with the sale of the home. Chapter 13 bankruptcy allows homeowners to restructure their debt and establish a repayment plan to catch up on missed mortgage payments. Chapter 7 may eliminate other debts, freeing up income to make mortgage payments more affordable. It is critical to understand how each type of bankruptcy affects foreclosure and long-term financial stability.

Challenging The Foreclosure In Court

Homeowners have the right to challenge foreclosure proceedings if they believe the lender has not followed proper legal procedures. In some cases, lenders fail to provide the required notices or documentation, making the foreclosure invalid. Mortgage servicers may also make errors in processing payments, which can lead to wrongful foreclosure. Additionally, if the lender cannot prove ownership of the loan, they may not have the legal authority to foreclose. Violations of state foreclosure laws can also provide grounds for a legal challenge. If a homeowner can present a strong case, a judge may dismiss the foreclosure or require the lender to correct any errors before proceeding. Taking legal action can be an effective way to delay or prevent foreclosure, but it requires a thorough understanding of foreclosure laws and procedures.

Government Assistance Programs

State and federal programs may provide financial relief for homeowners at risk of foreclosure. Some programs offer temporary mortgage assistance, refinancing options, or grants to cover missed payments. According to our Irvine foreclosure lawyer, homeowners should explore these programs early, as funding and eligibility requirements vary.

Seeking Legal Support

Facing foreclosure is a serious matter, and having the right legal guidance can make a difference. Whether negotiating with the lender, filing a court challenge, or exploring alternatives, homeowners benefit from legal representation that protects their rights.

If you or someone you know is facing foreclosure, Katje Law Group is here to help. Contact our award-winning Irvine foreclosure lawyer today to discuss your options and take the next step toward a solution.

Common Causes Of Foreclosure

As our Irvine, CA foreclosure lawyer knows, foreclosure can be overwhelming, especially when it feels like it happened quickly or without warning. In many cases, it’s not just one issue that leads to it, but a combination of factors over time. Whether you’re trying to avoid foreclosure or want to understand what causes it, knowing the most common reasons can help you take steps to protect your home. Our firm serves clients throughout Southern California and is prepared to help you. Here are some of the most frequent causes of foreclosure.

1. Job Loss or Reduced Income. Losing your job or facing a significant drop in income can make it difficult to keep up with mortgage payments. Many homeowners live paycheck to paycheck, so even a temporary loss of income can create long-term financial trouble. If you can’t make your monthly payments, missed payments can quickly add up.

2. Medical Expenses. Health issues can affect both your ability to work and your finances. Even with insurance, a major illness or injury often leads to large medical bills. When medical costs rise and income drops at the same time, it becomes harder to cover basic expenses, including your mortgage.

3. Divorce or Separation. A divorce or breakup can lead to financial strain for both parties, especially when there’s only one income covering the household bills. In many cases, neither person can afford the mortgage alone, and disagreements over who should pay can lead to missed payments.

4. Excessive Debt. As our Irvine foreclosure lawyer knows, when your monthly debt obligations—credit cards, car loans, student loans—outweigh your income, your mortgage may become harder to manage. Falling behind on other debts can also impact your credit score, which may limit refinancing options. It is crucial you speak with someone who works in finance and can help guide you.

5. Adjustable-Rate Mortgages (ARMs). Many homeowners sign up for ARMs without realizing how much their payments can increase once the fixed-rate period ends. When rates go up, monthly payments may become unaffordable, especially if your income hasn’t increased at the same pace.

6. Illness or Disability. Even without high medical bills, an illness or long-term disability can reduce your ability to work. This change in income may be permanent or unpredictable, and it often leads to missed payments over time.

7. Poor Financial Planning. Taking on a mortgage that’s too large or budgeting based on best-case income scenarios can lead to trouble. Life events like car repairs, job changes, or family emergencies can derail a tight budget and leave you short on funds for your mortgage.

8. Death Of A Co-Borrower Or Family Member. When a co-borrower passes away, the remaining borrower may not be able to afford the full mortgage. Inherited properties can also lead to foreclosure if heirs cannot keep up with payments or resolve estate issues quickly.

9. Property Value Decline. In some cases, your home’s value may fall below what you owe on the mortgage, especially after a market downturn. If you need to move or refinance and can’t sell the home for enough to pay off the loan, foreclosure becomes more likely.

10. Delays In Mortgage Assistance Or Modifications. Some homeowners try to get help through loan modifications or hardship programs but experience delays or denials. During this time, missed payments may continue to pile up, and foreclosure may begin before a solution is found.

At Katje Law Group, we have decades of experience and we work with people facing foreclosure and help them explore their options. If you’ve fallen behind on your mortgage or are at risk of losing your home, get in touch with our Irvine foreclosure lawyer to talk about what steps you can take next.

Call For A Case Evaluation

(714) 881-5200